Increased energy production from renewable sources is a major goal of many governments and organizations globally. As an example, the International Renewable Energy Agency highlights that the installation of offshore wind turbines will be critical to transitioning away from oil and aims for a goal of increasing the capacity of offshore wind turbines from 35 gigawatts to 2000 gigawatts by 2050. (Gielen & Lyons, 2022)

To reach these ambitious goals, greater effort will be required to supply the necessary amount of rare earth elements (REEs). Permanent magnet generators in offshore wind turbines alone can require up to 2 tons of rare-earth-containing magnets for a 3-megawatt drive, with 30% of that weight coming from neodymium (Pavel, et al., 2017).

While efforts are underway to reduce or eliminate the need for REEs, there are still applications for which the unique properties of REEs are required. This paper aims to highlight the opportunities and challenges present in rare earth materials manufacturing.

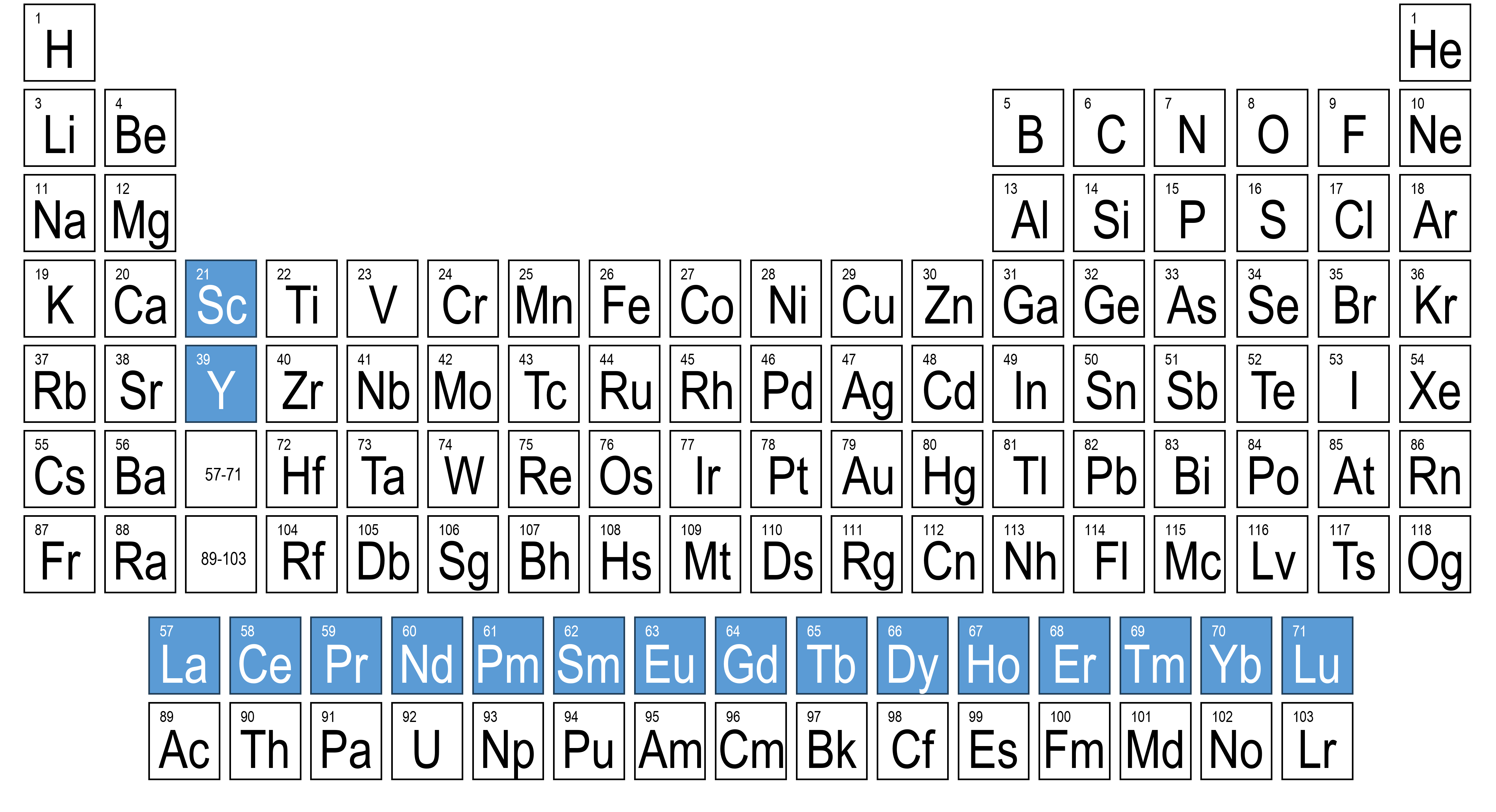

Rare earth elements are a group of 17 elements that include the lanthanide series (atomic numbers 57-71) as well as scandium and yttrium (see Figure 1). The REEs are grouped together because of their chemical similarity and unique chemical, physical, magnetic and optical properties.

These unique properties arise from the 4f electron configurations present in REEs, enabling interactions of a type not seen in other elements. For instance, REEs offer a variety of electron energy levels, which imparts a range of optical properties that make REEs versatile luminescent materials with applications in lighting, displays and optical information storage (Zhang & Zhang, 2022).

Figure 1. Periodic table with rare earth elements highlighted in blue.

We also see REEs used as different compounds (i.e., oxides, fluorides and alloys) in other applications:

While research is being conducted to find REE alternatives, no suitable replacement materials have been discovered. REE-based magnets have high energy density, which provides a more compact design in wind turbine generators, increasing their power generation and efficiency (Gielen & Lyons, 2022). Because of their criticality in the energy, defense and communications sectors, considerable effort is being expended to diversify the REE supply chain and ensure continuous access as demand increases.

To produce rare-earth-containing products such as permanent magnets, REEs must be mined, separated, processed and put through final product manufacturing. All of these steps have their own challenges that make the REE supply chain difficult to establish.

While the discovery of new REE mining sources is often newsworthy, it should be noted that these elements are not as rare as their name would suggest. REEs are prevalent in the earth’s crust in concentrations similar to elements such as copper, and are more common than gold.

However, unlike other elements, REEs are not found in nature as native metals, but rather are often combined in mineral deposits such as bastnaesite, which contains cerium, lanthanum, neodymium and praseodymium. Moreover, these mineral deposits are not commonly found in economically minable concentrations and are often a byproduct of other mining operations. For example, the Bayan Obo mine in China primarily mines iron ore but also extracts REEs as a byproduct. (Balaram, 2019).

Once ores are mined, individual REEs must be separated from one another, which can be challenging because of their chemical similarity. Mining and separating REEs also creates a significant amount of waste that often contains acids and radioactive elements such as uranium and thorium. These bystander elements create significant challenges for waste disposal and mine worker health and safety. Mitigating these risks, in turn, increases cost and reduces the economic viability of mining operations.

After separation, REEs are commonly supplied as oxides or carbonates, which can be further processed to produce other rare earth compounds including fluorides, metals and metal alloys. Materion has been sourcing and handling rare earth compounds since the 1980s to manufacture rare earth fluorides for the optical coating industry. By managing the safety and environmental impact of hydrofluoric acid, Materion provides a range of rare earth fluorides to customer-specific purity and performance specifications.

Rare earth fluorides can be further converted to metal through a metallothermic reaction or molten salt electrolysis methods. Metallization routes vary based on the desired REE. REEs are often separated into light REEs (atomic number 57-61) and heavy REEs (atomic number 62-71). Metal from light REEs can be produced through an electrolysis reaction, while heavy REEs are commonly produced via a metallothermic reaction.

Both manufacturing processes are required to produce metals needed for rare earth permanent magnets. For instance, one of the most important permanent magnets, NdFeB, contains the light REEs neodymium and praseodymium as well as the heavy REEs dysprosium and terbium. Materion produces beryllium metal through a similar method and provides small-scale samples of dysprosium and scandium through the metallothermic reduction of fluorides (see Figure 2).

Volatile markets subject to geopolitics and demand uncertainty present further challenges to the manufacture of REEs. This volatility creates risk for individual businesses, as all members of the supply chain depend on one another to ensure economic success.

As an example, if upstream mining operations are not viable because of low rare earth pricing in the market, separation and processing facilities will struggle from a lack of incoming material. If the cost of REEs is too high for magnet manufacturers, upstream operations cannot remain profitable. While increased supply chain stability may increase the adoption of rare earth materials and improve the market, the potential is unknown.

Figure 2. Samples of dysprosium and scandium metal produced at Materion.

Figure 2. Samples of dysprosium and scandium metal produced at Materion.

To avoid the difficulties inherent in new mining efforts, alternative sources of REEs are being investigated. Recycling, in particular, holds significant promise. REEs are already being recycled, but only in small quantities. Expanded electronic waste recycling could provide more access to REEs that require less processing; however, recycling efforts have often been low yield and high cost, making this effort challenging to commercialize.

Another source of REEs could be in deep sea mining. Nodules on the sea floor are expected to contain REEs that would be easier to extract than from mined ores. On the other hand, the environmental impact of mining the sea floor is not fully understood. Mining debris may have a large impact on underwater ecosystems. Such impacts, positive and negative, must be assessed as this potential source of critical elements is investigated.

REEs will continue to be important because of their unique properties, which are not easily mimicked by alternative materials. To address the challenges in manufacturing rare earth materials, collaboration between government and business will be vital in standing up the rare earth supply chain, especially if a U.S.-based domestic supply chain is desired.

Materion is working to play a role in this process, as we have been providing rare earth fluorides to the market for decades. With that experience comes insight into the rare earth market and supply chain that allows Materion to provide consistent and reliable product availability and meet customer product quality requirements.